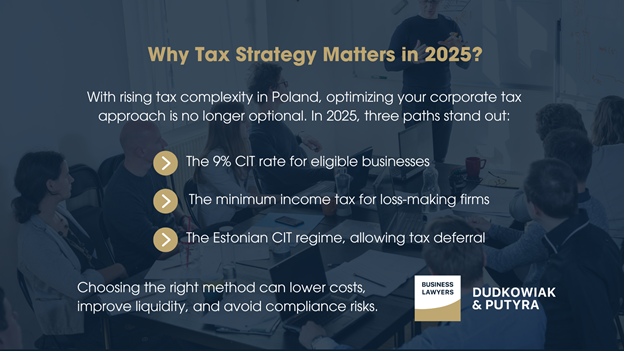

Why Tax Strategy Matters in 2025

With rising tax complexity in Poland, optimizing your corporate tax approach is no longer optional. In 2025, three paths stand out:

- The 9% CIT rate for eligible businesses

- The minimum income tax for loss-making firms

- The Estonian CIT regime, allowing tax deferral

Choosing the right method can lower costs, improve liquidity, and avoid compliance risks.

PICTURE 1

The 9% CIT Rate – For Small Taxpayers and New Firms

Poland’s reduced 9% CIT applies if:

- You qualify as a small taxpayer (revenue ≤ EUR 2 million in the previous tax year) or you’re in your first tax year

- Your revenue is from business operations (not capital gains)

The EUR 2 million cap for small taxpayer status is converted to PLN using the NBP rate on the first working day of October each year.

Ineligible entities include those from a number of restructurings.

Pro Tip: Monitor revenues closely and analyze restructurings if planning to apply the 9% rate.

Minimum Income Tax – What’s New in 2024

Applicable since 2024, this specific tax targets:

- Companies with operational losses

- Firms with ≤ 2% income-to-revenue ratio

Tax base includes:

- 1.5% of operating revenue

- Excess interest and service costs to related parties

Simplified method for tax base: 3% of operational revenue

Tax rate: 10%

Exemptions include among others::

- First 3 years of business

- Small taxpayers

- ≥30% drop in revenue

Tip: Review EBITDA and income margins regularly to stay above risk thresholds. Review tax exemptions strategically to minimize exposure to minimum income tax.

PICTURE 2

Estonian CIT – A Deferred Taxation Model

Key idea: No CIT until profit is distributed (e.g. dividends)

Advantages:

- Improves cash flow

- Simplifies tax reporting

- Lower combined CIT + PIT rates (20–25%)

Eligibility:

- Only individual shareholders

- Active business income

- No holdings in other entities

- Proper employment structure

- Timely notification to the tax authorities

Best for: Companies reinvesting profits over several years.

Summary – Which CIT Model Fits You Best?

| Option | Best For | Key Benefit |

| 9% CIT | Small or new companies | Lower tax rate |

| Minimum Tax Planning | Firms with slim margins | Compliance and forecasting |

| Estonian CIT | Growth-driven SMEs | Tax deferral and liquidity |

Strategic tax planning helps avoid unnecessary costs and maintain long-term financial health. Consult tax professionals to model outcomes before selecting a tax regime.

Want the Full Picture?

Explore our comprehensive blog post covering everything you need to know about Corporate Income Tax (CIT) in Poland – from standard rules to hidden exemptions.

FAQs – CIT, Estonian CIT in Poland

Can I switch between 9% CIT and Estonian CIT?

Yes, but it involves preparing a financial statement and providing a CIT return for the period from the start of the year until the day before the new tax system is introduced.

Is Estonian CIT suitable for holding companies?

No – only for operating companies with no shareholdings.

What if I exceed the 9% CIT revenue threshold?

You revert to the 19% standard rate.

Is the minimum tax additional to CIT?

It’s an alternative floor – if standard CIT is lower, you pay the minimum instead.