Marriage is about love, connection, and commitment, but it also comes with significant legal and financial implications.

In today’s world, where people are getting married later in life, bringing assets, businesses, or even children from previous relationships into the union, a prenuptial agreement is becoming more than just a formality. It’s a smart step in protecting both partners and setting expectations early on.

In Ontario, prenups are becoming increasingly common among couples who want to be transparent about finances and avoid unnecessary disputes in the future.

Whether you’re newly engaged or simply considering your legal options, understanding how prenups work in Ontario can help you make informed decisions about your future.

What Is a Prenup?

A prenuptial agreement, commonly referred to as a “prenup,” is a legally binding contract signed by two people before they get married. It outlines how property, debts, and other financial matters will be handled during the marriage and in the event of separation, divorce, or death.

In Ontario, prenups fall under the category of marriage contracts and are governed by the Family Law Act.

While they are often associated with the wealthy or celebrities, prenups are beneficial for any couple who wants to avoid misunderstandings and define their financial boundaries ahead of time.

Why Couples Are Choosing Prenups in Ontario

There’s a growing awareness that financial planning is a form of relationship planning. Couples today understand that being prepared doesn’t mean being pessimistic. In fact, open communication about money can lead to stronger relationships.

Here are a few common reasons why couples consider a prenup:

- One or both partners own a business and want to protect it in case of separation.

- There is a significant difference in income or assets, and each person wants to ensure fairness.

- One or both individuals have children from a previous relationship and wish to protect their inheritance.

- Debt is involved, and the partners want to clarify who is responsible for what.

- Future inheritances or family property are expected, and protection is needed.

Addressing the Stigma

Some people still feel awkward discussing prenuptial agreements, worrying that it may create tension or suggest a lack of trust. But legal experts, financial advisors, and even therapists agree that a well-structured prenup is about building a secure foundation.

A healthy relationship includes clear communication about expectations and responsibilities. A prenup encourages these conversations, providing legal clarity and emotional reassurance.

What Can Be Included in an Ontario Prenup?

Ontario prenups can include a wide range of terms, but they cannot deal with issues related to child custody or child support, as those are determined by the court based on the child’s best interests at the time of separation.

Here are the key areas that a prenup in Ontario can cover:

- Ownership and division of property

- Spousal support obligations

- Handling of debts and liabilities

- Treatment of future income or inheritance

- Business interests and shares

- Management of jointly owned assets

The agreement can be as detailed as needed, and it should reflect the couple’s unique circumstances and shared understanding.

Expert Insight: The Real Value of a Prenup

To better understand how prenups can benefit couples in Ontario, here’s a quote from a leading Canadian family lawyer:

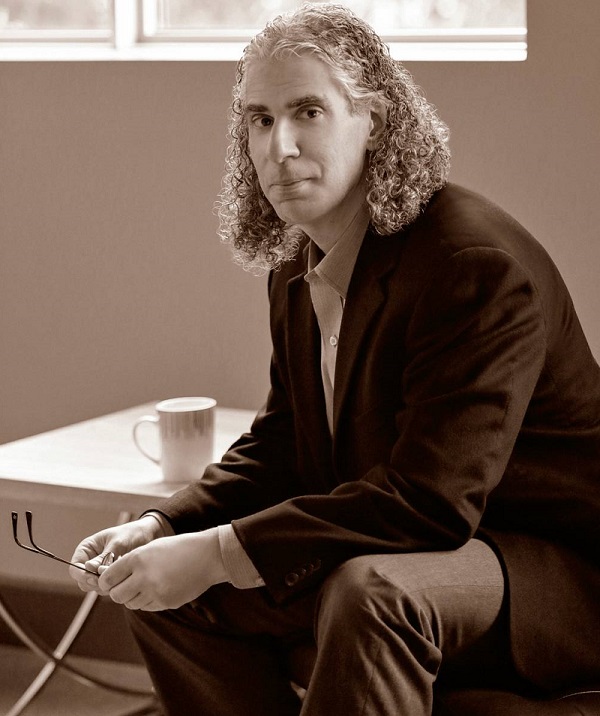

Jeffrey Behrendt, a trusted Canadian family law attorney, explained:

“Ontario Prenup agreements help modern couples protect their financial futures, reduce legal ambiguity, and ensure fairness, without undermining love or trust. When drafted properly, they provide clarity, peace of mind, and a sense of control over what matters most.”

This perspective highlights why more couples are embracing prenups not as a safety net for failure, but as a tool for building trust and understanding.

Legal Requirements for a Valid Prenup in Ontario

For a prenup to be legally binding and enforceable in Ontario, it must meet certain requirements:

- Written Agreement: The prenup must be in writing and signed by both parties.

- Full Financial Disclosure: Each partner must disclose their financial situation, including assets, liabilities, and income.

- Voluntary Consent: Neither person should feel pressured or coerced into signing.

- Independent Legal Advice: Both parties should have their own lawyer review the agreement before signing.

- Fairness and Reasonableness: While couples have freedom to decide their terms, the agreement should not be grossly unfair to either party.

Courts can set aside a prenup if it’s found to be signed under duress, involves misrepresentation, or is fundamentally unjust.

When to Create a Prenup

Ideally, a prenup should be drafted and signed well in advance of the wedding. Waiting until the last minute may suggest coercion or lack of time for proper legal advice, which can make the agreement vulnerable in court.

That said, if you’re already married, Ontario law also allows postnuptial agreements, which serve a similar purpose. It’s never too late to get your financial arrangements in writing.

Who Should Consider a Prenup?

Anyone who has assets they wish to protect or who wants clarity around financial matters should consider a prenup. You don’t need to be a millionaire to benefit from one.

A few scenarios where a prenup makes particular sense include:

- Entering a marriage with a home or investment property

- Expecting a family inheritance

- Owning intellectual property or shares in a company

- Having student loans, credit card debt, or financial obligations

- Planning to stay home to raise children and relying on one income

How to Start the Process

If you’re thinking about creating a prenup in Ontario, here’s how to begin:

- Start the conversation early. Approach the topic with honesty and sensitivity. Make it a team decision, not a demand.

- Make a list of assets and debts. This transparency is essential for both legal validity and mutual trust.

- Talk to a family lawyer. Each person should consult their own lawyer to ensure their interests are represented.

- Draft the agreement together. The final prenup should reflect a fair and agreed-upon understanding of how your finances will be managed.

Conclusion

An Ontario prenup isn’t about planning for divorce. It’s about starting a marriage with open communication, mutual respect, and shared expectations. It’s a thoughtful step that empowers couples to make decisions together and protect their future.

By working with a qualified family lawyer and approaching the process with honesty and care, couples can create a clear, fair, and legally sound agreement that supports their relationship, not undermines it.

If you’re planning to marry or just want to understand your options, take the time to explore how a prenup could benefit you. It might be one of the most important legal decisions you make as a couple.